Introduction to the Federal Funds Rate

Institutions lending their reserve balances at interest rates lower than what they earn from other lending institutions, is termed the federal funds rate. This is normally set overnight and is used for an uncollateralized loan. This term acts as a candid mark for most, if not all, short term interest rates and plays a significant role in the monetary policies of the United States of America.

The Federal Reserve’s Dual Mandate

To achieve a specific economic purpose, Congress created The Federal Reserve with two clearly outlined responsibilities:

Maximizing Employment: Chasing down the highest rates of employment while ensuring that the economy is not overheating with inflation.

Stabilizing Prices: Target is roughly 2% inflation per year, so that after years of spending, citizens can maintain some purchasing power.

Directly changing the federal funds rate is one way of achieving the goals, which the Fed usually intends to reach.

Adjustment in the federal funds rate is used due to changes of payments made from the fed to the banks. The simplest way to describe this is seeking to either add or remove control of inflation and closely monitoring employment figures.

Mechanism of Setting the Federal Funds Rate

The FOMC, also know as Federal Open Market Committee is a committee that meets regularly to define a specific target range that the federal fund rates can fluctuate to. The fed utilizes a few methods to adjust the true rate such as:

Open Market Operations: Trading of government assets, either buying or selling them becomes a way to manipulate the quantity of available reserve balances.

Interest on Reserve Balances (IORB): The interest paid for total reserves exceeding the set limit on deposits made by the banks at the fed is known as a control mechanism. This interest generally determines the willingness of the banks to lend money.

Discount Rate: The rate of interest that the Federal Reserve charges the banks for short term loans, which acts as secondary liquidity source.

vilfredo paretto

+1

All these actions are undertaken by the Fed in range with preset effective federal funds so that wider economic factors may be impacted using the value set by the federal funds rate as a tool.

henry wright

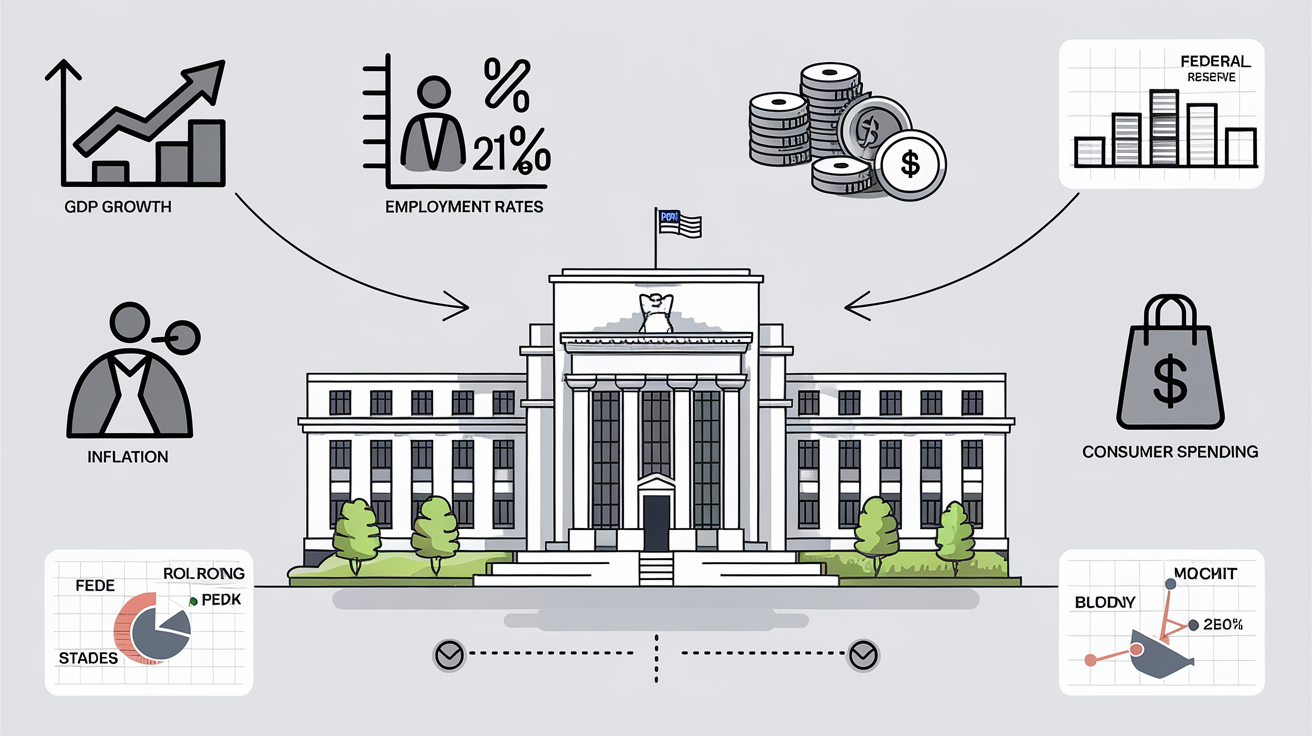

Economic Indicators Influencing the decisions of the policymakers

The Fed looks into several other strategy reports to assist in determining the federal funds rates.

ivan narvaez

a. Rates of Inflation

Inflation means a change over time in the amount a general basket of goods and services will cost. The target inflation rate set by the Fed is 2%. Breaching the limits also can result in negative consequences, thus forcing the federal reserve to consider increasing the federal funds rate.

+1

udzo

+1

b. Employment Information

Indicators such as unemployment and new jobs formed tell something about how the market is structured regarding employment. In times of high employment, wage driven inflation is also common and implies adjustment on federal interest rates in order to manage prices and inflation effectively.

c. Longitudinal Growth in GDP

The gross domestic product represents the totality of a country’s economic output within a designated timeframe.

Expansionary GDP growth can cause inflation which will require the Federal Reserve to change their current monetary stance by raising interest rates.

External Influence on Rate Decisions

Apart from domestic economic factors, other foreign elements are equally important for consideration by the Fed or any other central bank:

a. Trade Policy and Tariff

Import and export activities which a country engages in are determined by trade policies and the imposition of tariffs which can impact inflation and the growth of the economy. Changes in trade policy add volatility, especially concerning how the Fed evaluates economic activity.

+7

+7

+7

+1

+1

b. Global Economic Conditions

Foreign-developed economic activities affect the American economy through the trade and investment scope. The Federal Reserve takes into account the broader economic activity in order to predict the probable consequences of inflation and economic growth in America.

Recent Actions And Reasoning Of The Federal Reserve

During the past months, the Federal Reserve was forced to take some important decisions due to changes happening in the economy:

a. Rate Cuts In Times of Economic Uncertainty

The Fed has faced a string of challenges like trade wars and contradictory economic indicators which have compelled the Fed to lower the interest rates in an attempt to revitalize the economy. At the same time, the Fed has suggested that they will stay cautious, describing their position as one of waiting or reviewing to figure out the impact resulting from certain policy changes.

b. Managing Economic Growth along with Inflation

Trying to contain inflation and offer support for economic growth are equally crucial to the Fed, in equal measure. Federal funds rate changes are one of the elements that are used to manage this balance in order not to plunge the economy into recession, and yet try and maintain a handle on inflation. The Fed’s limitation is having to make sure inflation is not allowed to get out of hand, because when inflation is too high it can value decimate consumer buying power as well as create a lot of chaos within the country’s economy.

The Fed should also make certain that their policy measures do not hamper economic growth, or otherwise there will be higher unemployment levels and lower spending by the consumers. Every rate change decision is made behind this delicate concern balance.

Anticipated Effects of Rate Changes

Changes to the federal funds rate by the Federal Reserve come with a host of implications including possible negative repercussions of a broad spectrum of areas within the economy. Even a single decision leads to achingly high changes in the cost to service a debt, the amount of economic activities that take place in the nation, the behaviors of the consumers, and the whole operational cost of the financial institutions.

A. On Borrowing and Lending

An increase in the federal funds rate negatively impacts the interest a bank pays on borrowing, which increases the cost of loans extended to businesses and consumers. For instance, the interest on mortgages, auto loans, and credit cards tends to increase alongside the federal funds rate. Lowering these rates can slow down economic activity. When the Fed decreases their federal funds rate, the opposite occurs: borrowing becomes less expensive, and lends towards spending by consumers and investment by businesses, both of which increase economic activity.

B. On Investment and Savings

A change in interest rates shifts spending and savings tendencies as well. For example, the higher the interest rates become, the more appealing saving becomes because the return on savings accounts, bonds, and certificates increases. However, raising interest rates limits spending, as businesses are less likely to invest in expansion or capital projects. Decreasing interest rates also increases the likelihood of investment; however, low rates decrease the appeal of saving accounts and fixed-income investments.

Conclusion

Moving the federal funds rate is one of the most impactful decisions of the Federal Reserve because it can influence inflation, employment, economic growth, and investment. The Fed’s goal of maximizing employment while at the same time stabilizing the economy requires balancing different types of indicators such as inflation, employment, GDP growth, and other metrics such as trade and global economy. With the authority to exercise control over the federal funds rate, the Fed is able to manage economic stability, inflation, and foster economic growth. With that authority, however, comes a burden of responsibility, as the changes in the rate have powerful effects on the economy and the financial wellbeing of citizens and businesses.

The Federal Reserve’s decision to change the federal funds rate is exceptionally important because it affects inflation, employment, economic growth, and investment, all at the same time. Gauging the dual objectives of employment maximization and economy stabilization means dealing with a variety of measurement parameters like trade policies, global economy, inflation, employment rates, and GDP growth.

The autority to exercise control over the federal funds rate allows the Fed to maintain economic stability, manage inflation and promote growth. With such authority comes immense responsibility, for any change in the given rate can alter the economy profoundly, not to mention the financial wellbeing of citizens and businesses.

Frequently Asked Question (FAQ)

Why does the Fed change the federal funds rate?

In broad terms, the Federal Reserve alters the federal funds rate in an effort to target the economy as a whole, with the intention of managing inflation, price stability, and fostering employment opportunities. In theory, the Fed can either stimulate or restrain the economy by changing the rate, depending on hte economic situation.

What occurs when there’s an increase in the federal fund rate?

With the increase of federal funds, the federal funds rate increases as well. In this manner, the cost of borrowing increases for banks throughout the economy. As a result, when banks and consumers try to spend there is an increase in interest rates. These all lead to a reduction in the overall spending by consumers and businesses, reducing the pace of economic spending. In most cases, the intention is to reduce inflation and balance an economy that is heavily relied on.

Explain the link between the federal funds and the mortgage rates.

The payments made by the mortgage tend to be advanced with the increase of funds from the federal government, causing an increase in spending throughout banks. These higher expenses handed down will eventually have to be paid off by consumers paying higher mortgage rates to lenders. On the other hand, mortgage rates are reduced which leads to the possibility of refinancing. This means that less money is paid to the federal government leading to cheaper expenses when borrowing radiating from the private sector.

Examine the basic connection of the federal fund rates with inflation.

Inflation is directly associated with the federal funds. If inflation stalking increases beyond 2%, the funds from the federal government can increased in order to gain control on the whole economy. During these moments, lowering inflation has to be targeted. The other option is if inflation is increased, in that case the ratio can be increased in order to promote advancement in spending and based on the economic flow.

Can the Federal Reserve change the federal funds rate at any time they want?

The Federal Reserve is able to modify the federal funds rate at any given moment. However, it mostly makes these decisions during its periodic meetings, which occurs every six weeks. Under various economic conditions along with trends, these meetings have rate changes discussed and announced within them.

What Are Some Possible Side Effects From The Change In Rates Explanation?

The federal funds rate incurs several possible side effects with its change, some examples being the rate increments heightening the interest along with the broadening of loans spent by consumers. It’s possible that spending from consumers is lowered alongside fee charges for consumers. This might be the case if economic growth is absent. Alongside, rates being lowered drastically can increase spending and incite borrowing, however, this comes with spending being higher than what supply can back.

External resources Overview of the Federal Reserve – How the Federal Reserve features in the economy.

Monetary policy basics – Greater understanding on how the monetary policy issue works.

Leave a Reply