1. Introduction: Why You Might Want to Get a Business Credit Card

A business usually incurs many expenses, including office supplies, utilities, payroll, employee travel, and more. Managing these expenses without the right financial tools can be a hassle. Here is where a business credit card comes in handy.

In conjunction with helping you streamline your personal and business finances, a business credit card also provides rewards, cash back, and increases the financial security of your company. For entrepreneurs based in the U.S., having a business credit card stands out as a vital financial and growth resource, enabling access to funding alongside assisting in establishing a business credit profile.

2. Different Categories of Business Credit Cards

2.1 Rewards Business Credit Cards

This category includes cards that award points for every dollar spent on eligible purchases and offer to redeem the rewards for travel or merchandise. These business credit cards may be ideal for companies who spend a lot on operational expenses as they will be getting something in return.

2.2 Cash Back Business Credit Cards

Cash back business credit cards allow you to receive liquid reward payments as a percentage of your spending on business activities. For instance, you might earn anywhere from 1.5% to 3% of your purchases back in the form of cash back, which can be credited back to your card or withdrawn to a bank account. As is evident, these cards are simple and offer immediate rewards for your business.

2.3 Travel Business Credit Cards

For businesses that require their owners and employees to travel frequently, a travel business credit card will work best. These cards grant points that can be redeemed for travel-related purchases such as airline tickets, accommodation reservations, and vehicle rentals. Furthermore, a number of travel cards offer added benefits such as free baggage check, airport lounge access, and travel insurance.

3. Key Benefits of a Business Credit Card

3.1 Building Business Credit

One of the glaring advantages of a business credit card is how easy it makes establishing and building a business credit score. If a business pays its credit account in a timely manner and keeps its credit use low, it shows the credit score assigned to the business is justified, which may lead to appropriate subsequent financing services.

3.2 Streamlined Expense Control

Obtaining a business credit card streamlines expense tracking, since all purchases appear on a single statement. This form of expenditure tracking aids in budgeting and streamlines tax preparation at the end of the year.

3.3 Enhanced Cash Flow

Those suffering from cash flow challenges will benefit from the short-term financing that credit cards offer. The ability to buy now and pay later, sometimes with up to a month’s grace period, is a great relief to many people. This is essential for businesses that have to make urgent purchases but are awaiting revenue.

4. Conditions for Applying for a Business Credit Card

4.1 Credit Score Standards

Comparatively to personal cards, credit cards for business also have some requisite credit grade. They are set at 680 for most business credit cards, which is the score most issuers will accept. Businesses with a solid financial record may receive approval even when possessing lower scores.

4.2 Business’s Revenue and Profitability Requirements

These aspects will be evaluated by lenders. It is important for them to establish if you are able to service the credit limit and make the expected payments, hence their focus on the income generation ability of the business.

4.3 Bestowing a Personal Guarantee

As per some of the cards, there may be a need for a personal guarantee with business credit cards. This entails that, as the owner of the business, you will be liable to pay off any debt that occurred if the business is not in a position to pay it off. Having said that, the guarantee should be taken into consideration prior to trying to apply for a business credit card.

5. Steps Towards Choosing the Business Credit Card That Best Suits Your Company

5.1 Research Company Spending Patterns

Evaluating business credit cards means understanding how the business spends the money allocated. For example, if your advertising, office supplies, or fuel cover a significant share of your expenses, then it may be wise to take up a card that rewards those purchases with bonus points.

5.2 List Them Down And Assign Specific Importance To Each

Make sure they offer perks like rewards and cash back that can assist your business. For example, if your business has to travel often, it may make more sense to use a travel rewards card. Otherwise, if you want something more straightforward, a cash back card is beneficial.

5.3 Emphasis on Low Fees & Interest

Business credit cards come with a multiplicity of their fees like annual fees, charges for late payments, and fees for transactions abroad. Analyze the costs associated with each card and choose one that best fits your business, scope, and interest.

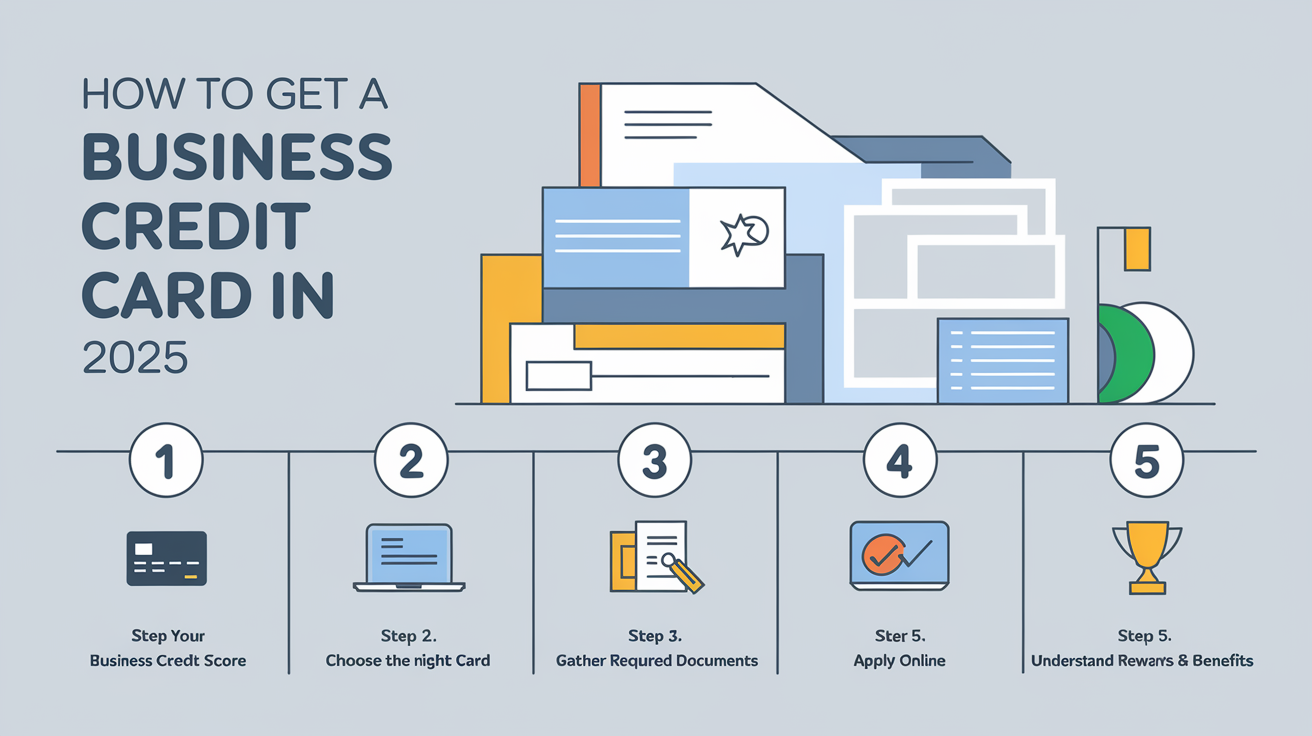

6. Stepwise Procedure for Applying for a Business Credit Card

6.1 Gather Relevant Documentation

In the application of a business credit card, there are several essential documents that should be compiled as follows: Some of the documentation could be the business financial statement, the business tax returns, business registration certificate, and the EIN number.

6.2 Submit Application

Move to the next step and choose a credit card that suits the business. Proceed to fill in the application form with all pertinent business information. Include additional details like monthly income, industry of the business, and personal details like social security number.

6.3 Familiarize with the Approval Stage

Under this section, inform them of the period within which the applicant must submit the application framework and expect feedback. This could last from several days to some weeks, with the flexibility resting on the card’s supplier. Upon confirmation, the client will receive the business card and start spending.

7. Business Credit Card Application Missteps

- Submitting Multiple Applications: Multiple submissions within a short span of time might lower your credit score.

- Disregarding Interest and Other Charges: Fees and interest rates should always be clearly outlined; read the fine print.

- Relapsing On-Time Payment: On-time payments are vital when building business credit.

8. Understanding Business Credit Card Fees

8.1 Fees For Not Using The Card Annually

Some business credit cards include an annual fee. While this fee may at times be compensated by rewards and benefits, thoroughly assess the offered value against incurred claims.

8.2 Fees Related To International Transactions

Foreign business, in specific, should look for the master cards without the foreign transaction fees because they add up.

8.3 Fees for Late Payments

Lack of adequate payment may lead to charges of several late fees as well as a low credit score. To avert such costs, utilize automated payment plans and other relevant assistance.

9. Establishing and Developing Commercial Credit with Business Credit Cards

Paying off the balance on your business credit card on a monthly basis and also maintaining low credit utilization helps put together a favorable credit profile. It increases the likelihood of being approved for larger loans and credit lines in the future.

10. Managing Business Credit Card Rewards

To optimize business credit card rewards, it is advisable to charge office supplies, utilities, and work-related travel to the card. Many cards give bonus award points for charging certain categories and focusing on those areas would result in getting the most rewards.

11. Business Credit Card vs. Personal Credit Card: What’s the Difference?

A business credit card is meant to cater for business expenses and comes with features like high credit limits and other business rewards. Unlike these, personal credit cards are meant for general use and do not carry these business-related perks.

12. Best Business Credit Cards for 2025 in the U.S.

- Chase Ink Business Preferred

- American Express Blue Business Plus

- Capital One Spark Cash for Business

- Wells Fargo Business Platinum Credit Card

These are some of the top-rated business credit cards for the year 2025. The following cards are available to suit businesses of all types, offering respective rewards and manageable benefits.

13. Business Credit Cards Questions and Answers

Q1: Am I allowed to mix personal expenses with business credit cards?

A1: There is a clear distinction between personal and business finances, and business credit cards should only be used for business expenses.

Q2: What steps do I need to take to boost my business credit score?

A2: To improve your score, ensure that bills are paid on time, maintain low credit utilization, and avoid multiple credit card applications in the short term.

Q3: What are the implications of defaulting on my business credit card?

A3: Defaulting can severely damage your business as well as personal credit scores and can result in legal action from the card issuer to reclaim the funds due to the debt.

Q4: How can I obtain a business credit card with no credit history?

A4: If a business lacks credit history, it may be best to apply for a secured business credit card or a personal guarantee may be needed.

Q5: Is a business license necessary when applying for a business credit card?

A5: A business license or EIN is needed for most card issuers before a business credit card can be issued.

Q6: Is there a business credit card that does not charge an annual fee?

A6: Yes, there are business credit cards that do not charge an annual fee, but they may offer fewer rewards or benefits compared to the ones with annual fees.

14. Conclusion

Business credit cards are an invaluable asset to entrepreneurs who wish to organize their finances, build credit, and earn rewards. Obtaining one is relatively easy as long as the steps covered in the earlier sections are followed. Evaluating the credit card types available alongside business needs and choosing the right application process aids in acquiring a card that aligns with the company’s financial goals. The right business credit card opens new opportunities for smart decisions that propel business growth.

Credit cards have been termed a scam and difficult to manage. Many entrepreneurs shudder at the thought of applying for them. After reading this guide, planning your application should be less daunting. Selecting a card that suits the needs of the ready-made business will lead to great flexibility and reward gratification.

Leave a Reply